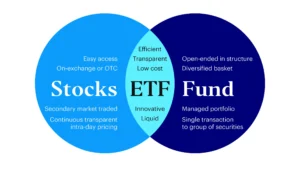

ETF full form stands for Exchange-Traded Fund. An ETF is essentially a fund which holds stocks, bonds, commodities, etc. ,that is traded on stock exchanges just like a regular stock. In practice, ETFs often track a benchmark index or asset – for example, many Indian ETFs mirror the CNX Nifty 50 or BSE Sensex. Because they trade on exchanges, ETFs combine the instant liquidity of shares with the diversification of mutual funds. Unlike mutual funds (priced only once per day), ETFs trade in real time and typically have lower expense ratios. Their prices fluctuates as the market moves. Globally, ETFs have seen explosive growth – the worldwide ETF industry reached a record $16.99 trillion in assets by mid-2025. In India, ETFs now cover equity indices, commodities, debt, and international markets, giving investors a simple way to access many asset classes.

Some of the ETF categories include:

-

Equity Index ETFs – Track stock indices (e.g. Nifty 50, Sensex). For instance, an ETF might hold all 50 Nifty stocks in proportion to the index.

-

Gold/Silver ETFs – Track precious metal prices (gold, silver) without holding physical bullion. (Investing in a gold ETF is like owning gold virtually.)

-

Sector/Theme ETFs – Focus on specific industries or themes (banking, IT, etc.).

-

International ETFs – Track foreign markets or global indices (like the S&P 500, Nasdaq, or MSCI indices).

-

Bond/Debt ETFs – Track fixed-income indices (government or corporate bonds).

These ETF types let beginners get broad market exposure and allow advanced investors to fine-tune portfolios easily. For example, an investor could use an ETF to simply buy the whole Nifty 50 or allocate to gold or bonds without picking individual securities.

Benefits of ETFs:

Many investors wonder if an “ETF is the best investment” for their portfolio. While no single asset is guaranteed, ETFs offer compelling advantages that often make them among the best choices for both beginners and seasoned investors. For one, ETFs typically have very low costs – most have minimal expense ratios and no entry/exit loads. They provide instant diversification: a single ETF unit spreads your money across a basket of stocks or bonds. Trading is easy too – ETFs are liquid and can be bought or sold intraday at any market price, unlike mutual funds which only trade once per day. Their holdings are also fully transparent (publish portfolio daily), and many are passively managed, keeping fees low. Tax-wise, ETFs are efficient: long-term capital gains are taxed at 10% (beyond ₹1 lakh) for equity ETFs, similar to equity funds but with fewer capital gain distributions.

-

Low Costs: ETFs often have expense ratios well below active funds.

-

Diversification: Own dozens (or hundreds) of stocks/bonds at once, reducing risk.

-

Liquidity: Trade ETFs instantly on the exchange; you can enter/exit any time during market hours.

-

Transparency: Daily disclosure of underlying holdings.

-

Tax Efficiency: Capital gains taxed only on sale (STCG 15% if <1 yr, LTCG 10% above ₹1L if >1 yr).

Taken together, these features often make ETFs one of the best investment vehicles for building a diversified portfolio. They are praised as low-risk (due to broad exposure) and convenient – even HDFC Mutual Fund notes that ETFs have “lower fees, higher liquidity, and better tax efficiency” than comparable mutual funds. However, ETFs still carry market risk (if the Market goes down, ETF price will also go down) and some niche ETFs can be illiquid. In general, investors choose ETFs for core, passive exposure and then may add other investments around them.

ETF Nifty: Investing in Index ETFs

In India, Nifty 50 ETFs are particularly popular. These ETFs aim to replicate the performance of India’s Nifty 50 index (top 50 large-cap companies). For example, Nippon India ETF Nifty 50 Bees, SBI Nifty 50 ETF, and UTI Nifty ETF all hold the same constituents as the index. By buying such an ETF, an investor effectively owns a tiny piece of all 50 Nifty companies at once. The result is that the ETF’s returns closely mirror the Nifty index. Indeed, over the last 10 years (April 2015 to August 2025) the Nifty 50 TRI index returned about 13.62% per year. In fact, ₹1,00,000 invested in a Nifty index fund in 2015 ,would have grown to around ₹3,58,548 by August 2025, showing the power of compounding in ETFs.

India’s ETF market is led by major fund houses. SBI Mutual Fund, for instance, has the highest ETF AUM (₹2.93 lakh crore), followed by Nippon India (₹1.06 lakh crore) and UTI (₹0.92 lakh crore). This reflects investors’ appetite for index ETFs: SBI’s large AUM comes largely from its Nifty and Sensex ETFs. In short, Nifty ETFs offer an easy “best of Indian equity” solution. They are efficient, low-cost, and have delivered strong historical returns.

ETF Gold: Investing in Gold ETFs

Gold ETFs provide a paper-based way to own gold. Each Gold ETF holds physical gold (99.5% purity) in the bank’s vaults, and its price movements track the metal. For example, Nippon India ETF Gold BeES and SBI Gold ETF are leading products. These let you participate in gold’s price without dealing with storage or security of physical gold. In short,investing in gold ETF is like investing in virtual gold.

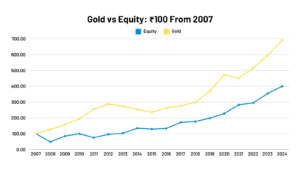

Gold ETFs have also shown impressive performance. In 2024, gold enjoyed a 27% return, significantly outpacing equity indices. This means a gold ETF would have jumped by 27%, whereas the Nifty 50 and S&P 500 returned much less in that period. Over the past decade, gold’s performance has been on par with equities: one analysis found a top gold ETF gave about 13.46% annualized over 10 years (₹1 L → ₹3.53 L), almost the same as the Nifty’s 13.62%.

Historically gold often rallies in turbulent markets while equities surge in growth periods. For instance, during the 2020 COVID crash, Nifty fell about 38% while gold rose 14%. This complementary behavior makes Gold ETFs a useful hedge. In India, gold ETFs have substantial assets – Nippon leads with ₹11,100 crore in gold ETF AUM (ICICI Gold ₹6,900cr, HDFC Gold ₹4,500cr). Investors often add gold ETFs to balance their portfolios and guard against inflation or market shocks.

-

Top Gold ETFs (AUM): Nippon India ETF Gold Bees (₹11,100 cr), ICICI Prudential Gold (₹6,900 cr), HDFC Gold ETF (₹4,500 cr).

Global ETFs: Worldwide Trends

According to ETFGI, global ETFs hit a record $16.99 trillion in assets (June 2025). In that month alone they saw $158.8 billion of net inflows (bringing 2025 YTD inflows to $897.6B, the highest ever). There are over 14,390 ETF products on 81 exchanges worldwide, covering virtually every market and sector.

The largest ETFs are mostly US market funds. For example, the iShares Core S&P 500 ETF (ticker IVV) has about $616 billion in assets, and it gathered a record $13.8 billion of inflows in one month. Its peer SPDR S&P 500 ETF (ticker SPY) has $633B. Other huge funds include broad stock market ETFs (Vanguard VTI), bond ETFs (AGG, BND), and even gold (GLD, $98B). In short, just as in India, global ETFs offer diversified exposure with low cost – making them indispensable tools for international investors as well.

For context: A recent study found that over the past decade, the Nifty 50 index and the US S&P 500 both roughly tripled – Nifty was +266%, S&P+263% from 2014 to 2024– illustrating the tight link in global equity returns. ETFs have allowed Indian investors to tap into these trends easily (for example, via international ETFs or feeder schemes).

Conclusion

Exchange-Traded Funds (ETFs) – whether tracking Nifty, gold, bonds or global markets – are a powerful, low-cost way to build a diversified portfolio. For Indian investors, broad-market ETFs like Nifty 50 and Gold ETFs have provided returns comparable to direct index investing, with the bonus of intraday trading and simplicity. As globally over $17 trillion flows into ETFs, the trend is clear: ETFs have become a mainstream investment for everyone from beginners to advanced traders. With the right choice of ETFs (and minding factors like expense ratio and tracking error), an investor can use them as core “best investment” building blocks, complementing other holdings like mutual funds or direct stocks.

Disclaimer: This blog is for informational and educational purposes only. It does not constitute financial, investment, or legal advice. Readers should do their own research or consult a qualified financial advisor before making any investment decisions related to ETF investing or other financial products.

For more insights on smart money moves and finance tips, visit us at mymoneyverse.in

One Comment