Mutual funds are a popular way for new investors to enter into the financial markets. By pooling money from many investors, mutual fund managers purchase diversified portfolios of stocks, bonds or other securities, all managed by professional fund managers. This means even beginners with small amounts can access a wide range of investments. Key benefits include professional management, built-in diversification, and low investment minimums. For example, many mutual funds in India allow Systematic Investment Plans (SIPs) starting from as little as ₹500 per month. These features make mutual funds a strong choice for those seeking long-term growth with manageable risk. There is no ” Top Mutual Funds India ” exists,it all depends on your goals,risk tolerance,time horizon and other factors.

Benefits Of Mutual Funds:

Some of the benefits of mutual funds are-

-

Diversification: Mutual funds spread investments across many assets, which helps reduce risk. Instead of buying one stock, you own a slice of an entire portfolio.

-

Professional Management: Experienced fund managers research and select securities, handling the day-to-day decisions.

-

Low Entry: SIPs allow you to start with small amounts (often ₹500 monthly) and benefit from rupee cost averaging.

-

Variety of Funds: You can choose equity funds, debt funds, hybrid (balanced) funds, and more to match your goals.

-

Liquidity: Most mutual funds let you buy or sell units easily at the fund’s Net Asset Value (NAV), which is calculated daily.

Investors often wonder “Are mutual funds the best investment for my goals?”. The answer depends on your objectives and risk tolerance. Mutual funds are generally better for medium to long-term goals, as the markets can fluctuate in the short term. By picking funds that match your time horizon and sticking with them through market ups and downs, you can build wealth over time. Remember, past performance is not a guarantee of future returns, so it’s important to invest with realistic expectations.

Types of Mutual Funds in India:

There is no single “best” mutual fund that fits everyone. Instead, the top mutual funds in India often refers to leading funds in different categories. The right choice depends on your risk profile. Mutuals Funds are of different types:

-

Large-Cap Funds (Safer Growth): These funds invest in the top 100 companies by market value. They offer relatively stable growth. Large-cap schemes are often “relatively safer” than mid- or small-cap funds. They suit investors seeking steady, moderate returns with lower volatility.

-

Flexi-Cap / Multi-Cap Funds (Balanced Growth): Flexi-cap funds spread investments across companies of all sizes and sectors. This flexibility allows fund managers to adapt to market trends. They are popular for investors with a moderate risk appetite, since they capture growth in whichever segments are performing well.

-

Aggressive Hybrid Funds (Balanced/Hybrid): Also known as equity-oriented balanced funds, these mix stocks (65–80%) with bonds (20–35%). This blend smooths out volatility while still offering growth potential. In fact, financial experts note that “aggressive hybrid schemes are considered relatively less volatile” and are a good option for newcomers who want equity exposure with some downside protection.

-

Mid-Cap & Small-Cap Funds (High Growth Potential): These funds invest in medium-sized (mid-cap) or smaller (small-cap) companies. They can be volatile, but they offer the potential for superior long-term returns. If you have a long investment horizon (5–10 years or more) and can tolerate market swings, these funds could boost growth. For example, small-cap funds have shown higher returns over long periods, but only if held patiently.

Always review a fund’s long-term track record, expense ratio, and risk factors before choosing. No fund is guaranteed to be a top performer next year. In fact, experts warn that searching for “the best” or “top” fund is often misleading – the right fund is the one that matches your personal goals, timeline, and risk comfort. A “top” fund for a conservative retiree might be very different from a “top” fund for a young investor saving for 10 years.

High Return Mutual Funds: Balancing Risk and Reward

Many investors seek high-return mutual funds, but higher returns usually come with higher risk. Typically, equity funds (especially mid- and small-cap funds) have delivered the highest growth over the long run, but their short-term ups and downs can be dramatic. Remember these points:

-

Long-Term Horizon: High-return funds often need 5–7+ years to show their potential. Over short periods, they can lose value.

-

Risk Profile: If you want aggressive growth, mid-/small-cap funds can deliver “superior returns over a long period”. However, this volatility may not suit everyone.

-

Diversify Within Equity: Even among equity funds, you can combine safer large-cap funds with higher-growth small-cap funds to balance risk.

-

Fees Matter: Actively managed funds tend to have higher expense ratios (fees) to pay managers, which can eat into returns. Always compare costs – lower fees mean more of your gains stay with you.

Investing in mutual funds for high returns is possible, but you must be willing to hold for the long term and accept market swings. Always match fund choice to your own time frame and comfort level.

Which Mutual Funds Are Best for SIPs?

A Systematic Investment Plan (SIP) is simply a way to invest in mutual funds regularly – for example, a fixed amount each month. SIPs harness the power of here rupee-cost averaging, which can smooth out market volatility. SIPs let you start small and stay disciplined:

-

Rupee-Cost Averaging: By buying every month, you buy more units when prices are low and fewer when prices are high, lowering your average cost over time.

-

Disciplined Savings: SIPs enforce regular investing. Many new investors find this helps build wealth without trying to time the market.

-

Low Minimums: You can begin with as little as ₹500–₹1000 per month.

As for which mutual fund is best for SIP, there is no one answer. SIPs can be done in any open-ended mutual fund. Often, beginners choose:

-

Balanced or Flexi-Cap Funds: These offer diversification. For example, an aggressive hybrid or flexi-cap fund automatically mixes equity and debt, suiting many SIP investors.

-

Large-Cap Funds: If you want stability, a large-cap fund via SIP can deliver steady growth.

-

Index Funds: Some prefer index mutual funds (or index ETFs) for SIPs because of very low fees and broad market exposure.

-

ELSS Funds: In India, you might consider Equity-Linked Saving Scheme (ELSS) funds, which are equity funds with tax benefits. SIP in an ELSS locks in each installment for 3 years, but still counts for tax deduction each year.

There is no “magic” SIP fund. Focus on consistency and let compounding work. The best SIP approach is to start early, continue steadily, and increase contributions as your income grows. And as always, ensure the fund’s goals match your goals.

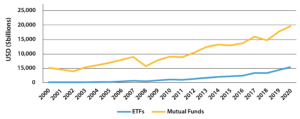

Mutual Funds vs ETFs: Key Differences

Mutual funds and Exchange-Traded Funds (ETFs) are both pooled investments, but they have key differences:

-

Trading: ETFs trade like stocks on an exchange throughout the day; their price fluctuates intraday. Mutual funds, on the other hand, are only priced and traded once per day after market close.

-

Management Style: Most ETFs are passively managed (tracking an index) and tend to have lower expense ratios. Mutual funds are often actively managed (aiming to beat an index), which can mean higher fees.

-

Purchase Method: You buy ETFs through a brokerage in share lots. Mutual fund orders (including SIPs) are placed directly with the fund house or a platform at the daily NAV. Mutual funds allow investing a fixed rupee amount (even fractional units), while ETFs require buying whole shares.

-

Minimum Investment: ETFs have no formal minimum aside from the price of one share. Mutual funds may have minimum amounts for lump-sum or SIP (often ₹500–₹1000).

-

Taxes: Both can be tax-efficient, but in some markets ETFs may generate fewer capital gains due to their structure. Tax treatment also depends on your country’s rules.

For most beginner investors, mutual funds (especially via SIP) are very convenient. They automate investing and often work directly with banks/portals. ETFs offer more flexibility if you want to trade actively or access very specific market niches. For a deeper dive on ETFs, see this guide on ETFs.

In summary, mutual funds are often seen as beginner-friendly investments because of their automatic approach and professional management, while ETFs are attractive for traders seeking intraday liquidity. Both serve to diversify your portfolio.

Mutual funds can be an excellent way for beginners and experienced investors alike to invest in diversified portfolios. By using SIPs and choosing the right type of fund, you can harness the potential of the stock market while managing risk. Remember, mutual funds are not guaranteed to earn high returns overnight — they reward patience and consistency. Always pick funds that match your investment goals, time horizon, and risk tolerance. With the right approach, mutual funds (whether equity, debt, or hybrid) remain one of the best investment options for building wealth over time.