Introduction:

Many people in India see taxes as a burden, but in reality, taxes are the backbone of our nation’s growth. From highways and hospitals to education and defense, every rupee collected as tax plays a vital role in building our future. With the New Income Tax Regime for FY 2025-26, it’s more important than ever to understand taxation in India and why paying taxes honestly is not just a duty—but a responsibility.

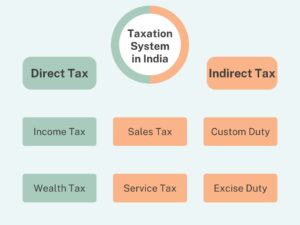

What is Taxation in India?

Taxation in India refers to the system through which the government collects money from individuals and businesses to fund public services and development. India has a well developed tax structure with clearly defining the authority between Central and State Governments and local bodies. Central Government levies taxes on income (except tax on agricultural income, which the State Governments can levy), customs duties, central excise and service tax. Broadly, taxes are divided into two categories:

-

Direct Taxes – Paid directly to the government, like Income Tax and Corporate Tax.

-

Indirect Taxes – Collected on goods and services, like GST (Goods & Services Tax).

Together, these taxes fuel the economy and ensure that the government has resources to improve infrastructure, provide welfare schemes, and strengthen national security.

New Income Tax Rules for FY 2025-26

The Union Budget 2025 introduced several changes under the New Tax Regime to simplify taxation and reduce the burden on middle-class taxpayers.

Revised Income Tax Slabs (FY 2025-26)

| Income Range (₹) | Tax Rate |

|---|---|

| 0 – 4,00,000 | 0% |

| 4,00,001 – 8,00,000 | 5% |

| 8,00,001 – 12,00,000 | 10% |

| 12,00,001 – 16,00,000 | 15% |

| 16,00,001 – 20,00,000 | 20% |

| 20,00,001 – 24,00,000 | 25% |

| Above 24,00,000 | 30% |

For further details please visit the web site of Income Tax Department at

: www.incometaxindia.gov.in ![]()

Other Key Updates:

-

Section 87A Rebate: Now up to ₹60,000, making income up to ₹12 lakh effectively tax-free.

-

Standard Deduction: Salaried individuals can claim ₹75,000.

-

Old Tax Regime: Still available as an option, but the new regime is now more attractive for most taxpayers.

Why Should You Pay Taxes?

Paying taxes may feel like money leaving your pocket, but here’s what it really means for you and the nation:

-

Infrastructure Development – Roads, bridges, metros, and airports.

-

Healthcare & Education – Public hospitals, affordable medicines, schools, and universities.

-

Defense & Security – Armed forces, police, and national safety.

-

Welfare Schemes – Subsidies, pensions, scholarships, and rural development.

Taxpayers are the backbone of the country and the tax collected from them is what helps the government run the country. We pay taxes to use the facilities provided by the government, welfare of the society and to protect the country. A robust tax system leads to economic and equitable growth of a country. Without taxes, none of these would be possible. Paying taxes is your direct contribution to India’s progress.

Where Does Tax Money Go in India?

Here’s a simplified breakdown of how your tax rupee is used:

-

Interest Payments & Debt Servicing – ~20–25%

-

Defence & Security – ~15%

-

Infrastructure & Development – ~20%

-

Subsidies & Welfare – ~15%

-

Healthcare & Education – ~10%

-

Others (Administration, States, etc.) – ~15%

This ensures that every citizen benefits in some way from the taxes collected.

Old vs New Tax Regime – Which One to Choose?

- New Regime Benefits: The new regime was first introduced with Budget 2020, with revised tax slabs and lower tax rates. A taxpayer opting for this regime had to give up on many exemptions and deductions such as HRA, LTA, Section 80C, 80D, etc. Consequently, several people continued the old tax regime for additional tax savings. Lower rates, higher rebate, simpler compliance. Best for those without heavy investments or exemptions.

- Old Regime Benefits: It allows the taxpayer to claim over 70 exemptions and deductions, such as the famous House Rent Allowance (HRA) and Leave Travel Allowance (LTA). These allowances further reduce the taxable income, thus, reducing the taxes a person is liable to pay. Useful if you claim multiple deductions like HRA, LTA, 80C, 80D, and home loan interest.

Shifting from one taxation scheme to another can be baffling, especially when balancing the old vs. new tax regime. The new approach may seem more beneficial given the changed conditions, the promise of lowered tax rates, and the ease of procedures for tax return submissions. On the contrary, the old scheme still offers a myriad of deductions, which may be more beneficial with proper investment.

Tip: Always calculate tax under both regimes before filing your return.

Tax Saving Tips in 2025

Even under the new regime, some deductions and strategies can reduce your liability:

-

Use the Standard Deduction of ₹75,000.

-

Invest in NPS (National Pension System) for additional benefits.

-

Take advantage of employer contributions to retirement funds.

-

For those in the old regime, maximize 80C investments (ELSS, PPF, LIC, etc.) and 80D health insurance deductions.

FAQs on Taxation in India

1. Who should file an Income Tax Return in India?

Anyone earning above the basic exemption limit (₹4 lakh in FY 2025-26) must file an ITR.

2. Is income up to ₹12 lakh tax-free in 2025?

Yes, under the new regime, after rebate and standard deduction, income up to ₹12 lakh may be effectively tax-free.

3. Can I still use the old tax regime?

Yes, the old regime is still an option. You can choose whichever is more beneficial.

4. What happens if I don’t pay taxes?

Non-compliance can result in penalties, interest, and even prosecution under the Income Tax Act.

Conclusion

Taxation in India is not just about compliance—it’s about nation-building. The new rules in 2025 have made paying taxes simpler and fairer for the middle class. By contributing your share, you not only stay compliant but also invest in India’s growth story.

Disclaimer: This blog is for informational purposes only and should not be considered as financial or tax advice. Readers are advised to consult a qualified tax professional or financial advisor for guidance specific to their individual situation.