Understanding the SWP (Systematic Withdrawal Plan) is essential to those who want a fixed income every month from their invested money. The SWP full form stands for Systematic Withdrawal Plan. SWP in mutual fund refers to a facility that lets you withdraw fixed amounts at regular intervals (monthly, quarterly, etc.) from your investment. In other words, it’s a way to generate a steady income stream from your fund without exiting completely. As The Economic Times explains: “It is a way to get a regular income from your mutual fund investment. You can choose a fixed amount and frequency of withdrawal — monthly, quarterly, or yearly — from a scheme”. This differentiates SWP from a lump-sum redemption.

Benefits of an SWP (Systematic Withdrawal Plan)

-

Steady Income: SWP provides a predictable payout schedule. Kotak highlights SWP’s benefit of “regular earning,” a “steady source of income” for investors . This makes it ideal for retirees or anyone needing a fixed monthly cash flow.

-

Flexibility: You control the amount and timing of withdrawals. You can change or stop the SWP anytime. Some platforms even allow you to pause or modify the plan online.

-

Tax Efficiency: SWP withdrawals are treated as redemptions and attract capital gains tax, but no tax is deducted at source. In practice, you receive the full amount in your account, and then pay tax based on the holding period and fund type. This can be more tax-efficient than dividend payouts (which historically carried a Dividend Distribution Tax). Kotak emphasizes that SWP “allows investors to manage their tax liabilities by spreading capital profits over time,” potentially reducing tax impact.

-

Rupee-Cost Averaging on Exit: By withdrawing regularly, you average out market volatility on the sell side. During some months you sell fewer units (when NAV is high) and more units (when NAV is low), smoothing out returns.

-

Corpus Continues to Grow: After each withdrawal, the remaining investment keeps compounding. As one platform puts it: “after withdrawal, the rest of your money stays invested and keeps growing”. You do not deplete the corpus all at once.

-

Discipline: Automatic withdrawals enforce a methodical approach and prevent rash financial decisions. SWP brings a “disciplined approach” to investing by imposing systematic withdrawals.

Overall, a well-planned SWP can combine the benefits of equity/debt growth with regular cash flow. As ET notes, advisors see SWPs as a “tax-efficient way to draw regular income from mutual funds”, even a smart alternative to parking money in fixed deposits.

How SWP Works: Investing in a Systematic Withdrawal Plan

Setting up an SWP is straightforward:

-

Invest in a Mutual Fund: First, choose a suitable mutual fund (equity, hybrid or debt, matching your risk profile) and invest a lump sum (or accumulate via SIPs).

-

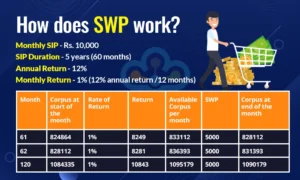

Set Up the SWP: Instruct the fund house or your broker to start an SWP. You specify the withdrawal amount (e.g. ₹10,000) and frequency (monthly, quarterly, etc.). You can also often choose to withdraw only the gains (appreciation) if you wish.

-

Automatic Withdrawals Begin: On each scheduled date, the mutual fund automatically sells units to withdraw the chosen amount and transfers the cash to your bank account. The remaining units stay invested and continue to earn returns.

For example, Kotak Mahindra Bank describes SWP as allowing the investor to “specify the amount of funds they wish to cash out from their mutual funds” on each date, with the fund selling units to meet the request. In practice, you might invest ₹5 lakh in a balanced or debt fund, then set an SWP of ₹20,000 per month. Over time, you will receive ₹20,000 into your bank each month, while the rest of the ₹5 lakh continues growing.

SWP vs SIP: Key Differences

A Systematic Investment Plan (SIP) is the opposite of an SWP. In an SIP, you invest fixed amounts regularly, but in an Systematic withdrawl plan (SWP), you withdraw fixed amounts regularly. ET notes: “SWP is just the opposite of SIP… In SIP, you invest money regularly, while in SWP, the money is withdrawn systematically to create a steady income stream”. In summary:

-

Purpose: SIP is for building wealth over time, on the other hand, SWP is for generating regular income. SIP adds to your corpus, while SWP reduces it as you withdraw.

-

Cash Flow: SIP requires you to pay in each month/quarter. SWP pays you each month/quarter.

-

Capital Impact: With an SWP, your invested corpus declines if you withdraw more than the fund earns. SIP increases your corpus over time. As Kotak’s comparison shows, SWP “offers regular income cashing out from investment” whereas SIP “builds returns over time via regular investment”.

-

When to Use: Use SIP when you have surplus cash to invest now; use SWP when you have a lump sum or existing investment and you need periodic cash flows (for example, in retirement).

How to Invest in an SWP Mutual Fund

-

Select the Fund: Choose a mutual fund aligned with your goals. Conservative options (debt, hybrid) are common for SWP, as discussed below.

-

Lump-Sum Investment: Invest your capital in the chosen fund (you can first build this corpus via SIPs or a lump-sum).

-

Set Up the SWP: Through the fund house or online platform, go to the SWP option. Enter the withdrawal amount, frequency (monthly, quarterly, etc.), and start date. Confirm and submit.

-

Receive Payouts: The fund will then sell units and deposit your specified amount to your bank as per schedule.

-

Monitor and Adjust: You can change the withdrawal amount or frequency (often at any time) and even stop the SWP without penalty.

In summary, “to invest in a SWP mutual fund, start by selecting a suitable mutual fund that aligns with your goals,then set up your SWP by deciding how much money you want to withdraw and how often”. Essentially, SWP is not a separate fund but a withdrawal facility on a mutual fund you already own.

Who Should Use an SWP?

An SWP is especially useful for:

-

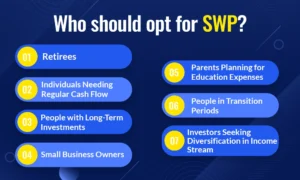

Retirees and Regular-Income Seekers: SWP creates a pension-like income. It’s “perfect for retirees or anyone who wants a steady monthly income”. Instead of depleting savings in one go, you can draw moderate amounts over many years. Retirement planners often recommend a 3.5–4% annual withdrawal rate to sustain long-term income. For example, a ₹50 lakh corpus earning 8% a year could safely yield about ₹14,000–₹16,000 per month.

-

High-Tax or Security-Conscious Investors: Since SWP involves no TDS, investors in higher tax brackets can optimize timing of gains. SWP is “helpful for high-tax payers” as there is no immediate tax on payout. You pay tax only as capital gains in your return.

-

Capital Preservation Traders: If you prefer not to touch the principal, you can set up an appreciation SWP that only withdraws gains. This protects your original corpus (though future payouts may shrink if the fund underperforms). Use it as safe investing as one use – withdraw only profit while keeping principal intact.

-

Pre-Retirement Planners: Investors with a growing mutual fund corpus can plan ahead: accumulate wealth now, then switch to SWP once retired to get regular payouts.

-

Investors Preferring Diversified Income: Unlike dividends (which depend on fund payouts) or FDs (which are single-asset), SWP lets you benefit from market growth in a diversified portfolio while still taking out cash.

An SWP’s success depends on market returns. In a prolonged bear market, withdrawals may exceed gains and erode capital. Financial advisors caution that SWP is not a guaranteed income – if markets stay weak, your corpus could deplete faster. Always choose a sustainable withdrawal rate.SWPs may seem attractive in theory, but their effectiveness depends on market performance.

SWP vs Other Payout Options

-

Dividend Option vs SWP: A dividend plan pays out from a fund’s distributable surplus, but it’s irregular and (in the past) was subject to Dividend Distribution Tax. SWP provides precise control, you get exactly the amount and timing you choose. There’s no TDS on SWP, you only face capital gains tax on each redemption.

-

SWP vs Fixed Deposits: Many experts now view SWPs as an alternative to bank FDs for retirees. Since the remaining corpus stays invested in a mix of equities/debt, SWP can offer higher post-tax returns and beat inflation, while still giving monthly cash. It can be treated as “tax-efficient way to draw regular income” even compared to FDs.

-

Lump-Sum Withdrawal: Taking out all money at once can spike your tax bill and end compounding. SWP spreads tax liability and allows the rest of your money to keep working.

Best SWP Mutual Funds for Monthly Income

SWP itself is a withdrawal facility, not a fund category. However, some funds are commonly used for SWP because they deliver steady returns and low volatility. Experts typically recommend hybrid/balanced funds or debt-oriented funds for SWP. For example, Tata Capital Moneyfy’s 2025 recommendations include:

-

HDFC Hybrid Equity Fund (Reg – Growth): A large-cap oriented hybrid (65% equities, 35% debt) aiming for growth with moderate risk. It’s often used by SWP investors seeking some equity upside.

-

ICICI Prudential Balanced Advantage Fund: A dynamic allocation fund (currently 66% equity) that adjusts between stocks and debt. It aims for capital appreciation and income, making it suitable for long-term SWP withdrawers.

-

SBI Magnum Medium Duration Fund (Reg – Growth): A debt fund with 3–4 year duration portfolio. It focuses on debt and money-market instruments to deliver moderate returns and liquidity. Being a debt fund, it provides stable returns, which can be withdrawn monthly.

-

Axis Equity Saver Fund: An equity-plus-debt scheme (65% equity, 29% debt) designed for capital appreciation and income with lower volatility. Its investment objective explicitly includes generating income from debt.

-

Aditya Birla Sun Life Regular Savings Fund (G): A hybrid debt scheme (75% debt) built for regular payouts. Its primary objective is “to generate regular income to make monthly payments to its unitholders”. This fund is a textbook example of an SWP-friendly scheme focused on monthly income.

Other fund categories to consider for SWP:

-

Debt Funds (Ultra Short or Monthly Income Plans): These invest in high-quality bonds for stable returns. They offer predictability and low equity risk. Examples include medium- to short-term government or high-rated corporate bond funds.

-

Arbitrage or Conservative Hybrid Funds: For very low risk, one could park money in arbitrage funds (which earn small equity returns with very low volatility) and set up an SWP from them.

-

Balanced/Hybrid Equity Funds: Aside from the ones above, many “aggressive hybrid” or balanced funds (60–65% equity) rank highly in SWP backtests.

-

Balanced Advantage Funds: As with ICICI Pru above, dynamic equity funds that adjust exposure.

Note: There is no single “best SWP fund.” The right choice depends on your income need and risk profile. Generally, debt and balanced funds are safer for monthly withdrawals, while pure equity funds carry higher risk. Always check a fund’s track record and suitability. Remember that past performance does not guarantee future returns. Consult a financial advisor if unsure.

Conclusion

A Systematic Withdrawal Plan (SWP) is a disciplined way to convert your mutual fund savings into regular income. By choosing the withdrawal amount and interval, you can tailor it to your cash-flow needs. SWP is tax-efficient (no tax is deducted upfront) and can apply to almost any mutual fund. It is especially popular among retirees and those needing monthly income, as it provides “a predictable and steady source of revenue” from investments. To implement an SWP, simply invest in a suitable mutual fund and instruct the fund house to start systematic withdrawals. Always pick funds aligned with your goals—typically hybrid/debt funds for retirees—and set a sustainable withdrawal rate. Finally, stay mindful that market swings can affect how long your corpus lasts. In summary, SWP can be a powerful tool for regular income, but like any investment strategy it should be planned carefully and reviewed with professional advice.

Disclaimer: This blog is for informational purposes only and should not be taken as financial or investment advice. Please consult a certified advisor before investing.