Aman Gupta is a prominent Indian entrepreneur, best known as the co‑founder and CMO of boAt Lifestyle, a leading audio electronics brand. Starting with just ₹30 lakh of personal funds in 2016, Aman Gupta helped grow boAt into a household name in India’s headphone and wearable market. As of 2024, Aman Gupta net worth is estimated at around ₹720 crore ($87 million), largely from boAt’s success and his savvy investments. This article explores the Aman Gupta boAt case study of under Aman Gupta’s leadership, covering the company’s growth strategies, ownership stake, and his role as a Shark Tank India investor.

Co‑founding boAt and Building a Brand:

Aman Gupta , born in 1982 ,built his career on strong business foundations. A Chartered Accountant and an MBA by training, he worked at Citi and KPMG before co‑founding tech ventures. He then moved into the consumer electronics industry, serving as a Sales Head and Director at JBL (Harman International). In 2016 he launched boAt with his childhood friend Sameer Mehta, aiming to fill a gap for stylish yet affordable audio accessories. The brand’s first products were rugged, tangle‑free charging cables, which struck a chord with young consumers tired of flimsier imports. By focusing on quality design (e.g. water-resistant earbuds) and fashion‑forward colors, boAt quickly positioned itself as a lifestyle brand rather than a generic electronics label.

-

Bootstrapped start: Gupta and Mehta invested just ₹30 lakh of their own savings to kickstart boAt in 2016. Banks refused loans and VCs were skeptical of a hardware startup, so the founders reinvested initial sales to fund growth.

-

Product roadmap: After cables, boAt rapidly expanded into headphones, speakers, smartwatches and fitness trackers. This broadening product line kept the brand fresh and enabled upselling to its growing customer base.

-

Digital first: From day one, boAt was sold direct‑to‑consumer online. The company built a strong presence on Amazon, Flipkart, Myntra and other e‑commerce platforms. This D2C model minimized costs and helped the brand scale nationwide without expensive retail outlets.

-

Community‑driven: Crucially, boAt cultivated a fan community known as the #boAtheads. Youth audiences were encouraged to share selfies and reviews with hashtags like #IAmboAthead. By 2020, an online boAtheads community exceeded 3 million people, driving organic word-of-mouth growth. Gupta’s marketing leaned on relatable content rather than big TV ads, giving boAt a youthful image.

Today, boAt is widely recognized as India’s #1 audio wearables brand. It earned this status through value-driven design and savvy branding. For example, boAt products have even been showcased at fashion events (like Lakmé Fashion Week) to cement the message that sound meets style. The combination of trendy designs, celebrity/influencer endorsements, and social media buzz let boAt capture about 30% of the Indian headphone market.

boAt’s Growth Strategy and Success Metrics

The boAt is often set as an example of lean execution and cultural marketing. Key tactics under Aman Gupta’s leadership included:

-

Influencer & Pop Culture Marketing: BoAt partnered with popular music artists, sports stars and social media influencers. Gupta himself said boAt “let its users do the talking” by tapping into youth trends. Viral campaigns around music festivals and cricket events, plus memes and online contests, gave boAt a constant digital presence.

-

Community Engagement: BoAt viewed customers as brand ambassadors. Special loyalty programs (e.g. discount codes for repeat buyers) and user‑generated content kept engagement high. This strategy turned customers into campaigner, strengthening brand loyalty at low marketing cost.

-

Product Innovation & Expansion: BoAt continually refreshed its product line. After capturing the audio segment, the brand moved into smartwatches and lifestyle gadgets. This kept revenue rising and helped position boAt as a comprehensive tech accessory brand.

-

Data‑Driven Pricing: Aman Gupta applied his finance background to pricing. BoAt maintained a delicate balance of affordable but not cheap product. By closely managing inventory and manufacturing abroad, the company could offer premium features at lower prices than competitors, driving high volumes.

These moves paid off in hard numbers. Annual revenues skyrocketed from roughly ₹31 crore in boAt’s first year to ₹701 crore by FY2020 and about ₹3,122 crore by FY2024. This explosive growth made boAt one of the fastest‑scaling startups in India’s consumer electronics space. It also attracted significant investment: Warburg Pincus and other funds poured money into boAt’s parent company, Imagine Marketing, from 2018 onward. By late 2022 boAt had raised over $116 million in total funding.

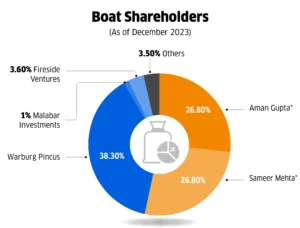

In 2022, boAt took the final step to the public markets. Its IPO raised ₹900 crore (fresh issue) plus ₹1,100 crore through share sales. In that listing, co‑founders Aman Gupta and Sameer Mehta each sold about ₹150 crore worth of shares. Before the IPO, Aman Gupta held roughly 28.3% of boAt’s parent company. (After the sale, his stake was diluted to around 26–27%.) Today the brand is often referred to as India’s $1‑billion earphones startup, and is ranked among the world’s top five wearable brands. (boAt’s parent company is preparing to launch the IPO after a previous attempt was withdrawn in 2022 due to market conditions)

Aman Gupta’s Net Worth and boAt Stake

Given boAt’s meteoric rise, Aman Gupta’s personal wealth has grown correspondingly. As one of the principal founders, he retains a significant equity share in the company. Public filings around the IPO indicated Aman Gupta owned 28.26% of Imagine Marketing(Parent company of boAt) before listing. Post-IPO reports suggest his direct shareholding is now about 26.8% as of early 2025. At boAt’s latest valuation, that stake is worth several hundred crore rupees on paper.

Based on these holdings and other investments, Aman Gupta’s net worth is estimated to be in the high hundreds of crores. For example, the Times of India reports that as of 2024 his net worth is about ₹720 crore ($87 million). This matches figures from other sources (around ₹700–720 cr). A large portion of this wealth comes from his boAt shares. (He also owns equity in several startups he backed on Shark Tank India.)

In practical terms, Aman Gupta’s net worth and company stake have multiple effects: it fuels his lifestyle and public profile, and it also gives him a substantial say in boAt’s direction. In interviews he has joked about luxury cars and coaching cricket teams, but he also emphasizes remaining grounded. As one headline quipped, with a ₹700 cr net worth, Gupta noted that success did change some friendships and humbled him. Overall, the financial rewards have validated boAt’s strategy: a homegrown electronics brand that is both profitable and resonant with Indian consumers.

Aman Gupta and Shark Tank India

Beyond boAt, Aman Gupta is widely recognized for his role on Shark Tank India. Since the show’s debut in 2021, Gupta has been a regular “Shark” or investor-judge. His presence on television has boosted his fame and reinforced boAt’s brand image. Viewers know him as the charismatic shark who brings startup expertise (and a dose of humor) to pitches.

Gupta’s Shark Tank involvement ties back into boAt’s story in a few ways:

-

Mentorship and Investments: Gupta has invested in dozens of startups on the show, often in sectors like food, wellness and fashion where he sees growth potential. These investments diversify his portfolio and leverage the same eye for trends that made boAt successful.

-

Brand Visibility: Appearing weekly on primetime television has kept Aman Gupta (and by extension boAt) top-of-mind for many consumers. This media exposure has “cemented his image as a trustworthy, relatable entrepreneur”. BoAt often ties Shark Tank promotions to product campaigns, subtly cross-promoting.

-

Inspirational Figure: As a Shark Tank judge, Gupta embodies the narrative of a self-made founder. He often shares boAt’s lessons when advising entrepreneurs, such as “focus on customers, not just funding.” This thought leadership role further elevates his expertise and authority.

In Short:

The Aman Gupta boAt case study offers several lessons: a clear vision for a market gap, frugal but creative growth tactics, and the leveraging of one’s personal brand. Gupta’s informative approach, with regularly shared metrics and storytelling about boAt, builds trust with the audience. From ₹30 lakh seed money to a ₹700‑billion‑plus company, boAt’s story is grounded in real figures. Aman Gupta’s story is really an inspiration for all of us and we learn much from him.

Disclaimer:

This article is for informational purposes only. The data on Aman Gupta’s net worth, company valuation, and shareholding are based on publicly available sources and may vary over time.Explor more business case studies on mymoneyverse.in